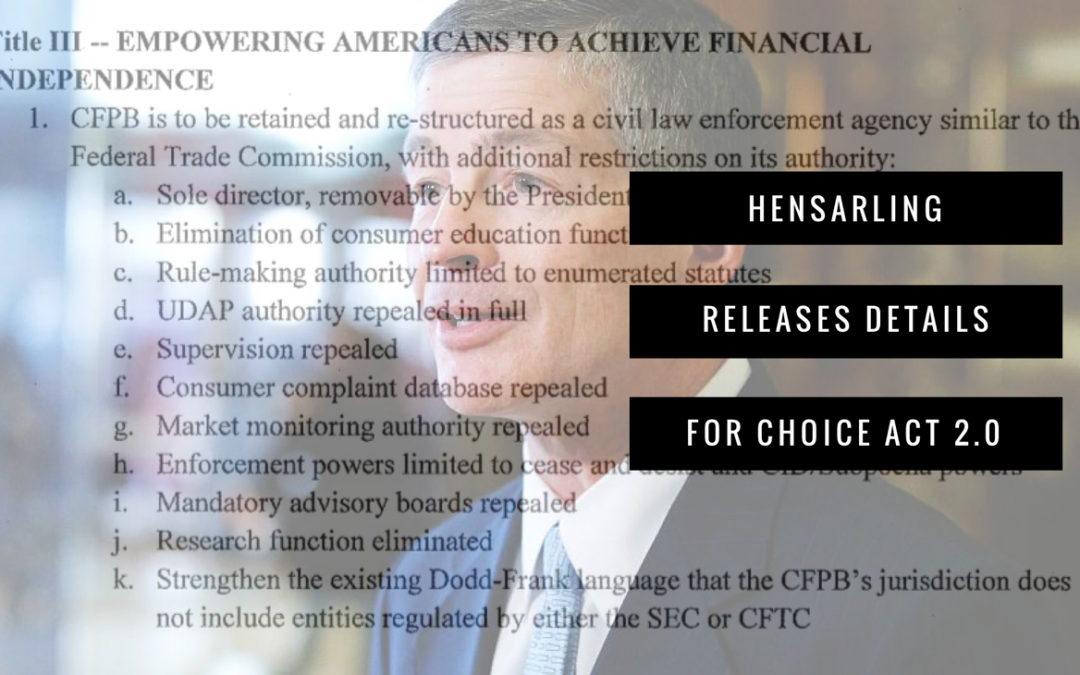

Following up on a memo distributed in February, Rep. Jeb Hensarling (R- TX), Chairman of the House Financial Services Committee, released more information on a proposed bill to renovate the Dodd-Frank Act, dubbed CHOICE Act 2.0. In particular, CHOICE Act 2.0 proposes significant changes to the leadership structure and authority of the Consumer Financial Protection Bureau (CFPB) by making the director serve at the leisure of the President. The CHOICE Act 2.0 would also limit the CFPB to enforcement of existing federal laws only, eliminating the agency’s supervisory function, rulemaking authority, and its ability to monitor financial markets. The full bill is expected to be introduced in the House of Representatives by the end of April.

Recent litigation involving the CFPB has directly challenged the constitutionality of the agency’s single director leadership structure only fireable for cause by the President. With the Trump Administration pulling its support of the agency’s position in that case, it appears that a legislative or judicial fix to CFPB’s constitutionality concern may come soon via making the agency’s director fireable at will by the President.

While reforms to Dodd-Frank and the CFPB are expecting considerable support in the House, the Senate may pose a stronger challenge to federal financial services reform. Without a sixty vote supermajority in the Senate, Republicans will likely need Democratic support to see the CHOICE Act 2.0 through both houses of Congress. Senate Republicans are pushing for such a compromise across the aisle, but the bill may require revisions to become palatable. The Consumer Bankers Association is also increasing pressure on both parties in the Senate to find a way to reform Dodd-Frank.

See a side-by-side comparison of the CHOICE Act 2.0 with its predecessor here.