Colorado Voters Approve Ballot Measure Capping Interest Rates on Short-Term Loans

← Previous Article Next Article → A majority of Colorado voters supported a ballot measure on Tuesday that would cap interest rates on payday loans at 36 percent and restrict certain lenders from collecting monthly maintenance and origination fees. This most...

Native American Representation Increases in a Historic Election

← Previous Article Next Article → U.S. voters sent a record number of Native Americans to Congress during the 2018 midterm elections. Making this an even more historic moment, two of them will be the first Native American women to ever walk the halls of...

A Divided Congress: What It Means for Financial Services

← Previous Article Next Article → A Divided Congress: What It Means for Financial Services On November 6, 2018, an increasingly polarized electorate voted for a divided Congress. Democrats took control of the House while Republicans maintained a...

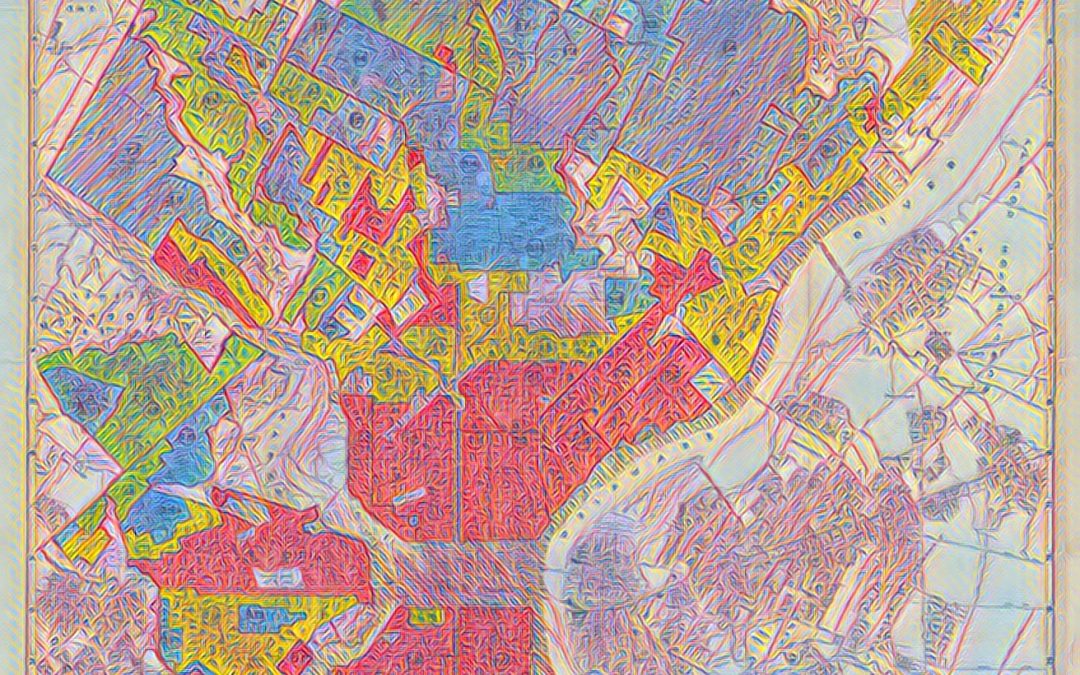

State Investigations into Redlining Continue

← Previous Article Next Article → In mid-October, Pennsylvania’s Attorney General Josh Shapiro ratcheted up an investigation into redlining by calling on Philadelphia residents to file official complaints if they feel they have been redlined when applying...

Mulvaney and the Decline in Enforcement Actions at the CFPB

← Previous Article Next Article → Over the past year, there has substantial concern among consumer watchdogs that the Consumer Financial Protection Bureau (CFPB) has initiated fewer enforcement actions against financial services companies under Acting...

Congressmen Urge Federal Reserve to Mandate Real-Time Payments

← Previous Article Next Article → Earlier this week, four members of the Congressional Black Caucus sent a letter to Federal Reserve Chairman Jerome Powell urging the federal agency to mandate real-time payments. This is becoming an increasingly important...

NAFSA Celebrates National Native American Heritage Month

← Previous Article Next Article → The Native American Financial Services Association (NAFSA) is celebrating National Native American Heritage Month this November. We are taking this time to recognize the ancestry and time-honored traditions of American...

Federal Reserve Proposes Lighter Regulations for Mid-sized Banks

← Previous Article Next Article → The Federal Reserve announced a pair of proposals today that would significantly lighten the regulations on banks with assets between $100 billion and $250 billion while maintaining strict standards for the largest and...