Kraninger Nomination Gets Endorsements, even as Sen. Warren Places a Hold

← Previous Article Next Article → In a column yesterday, the Wall Street Journal Editorial Board made the case that President Trump’s CFPB nominee Kathy Kraninger, announced over the weekend, has the qualifications necessary to lead the Bureau and should be...

With CFPB Turning Away from Enforcement, State Bank Supervisors May Fill the Void, Argues CSBS Chair

← Previous Article Next Article → This week, in a column published on American Banker, Charlotte Corley argues that state financial services regulators may be gearing up to fill the void left by the CFPB’s shift away from enforcement under the Trump...

White House Announces Kathy Kraninger as Nominee to Head CFPB

← Previous Article Next Article → On Saturday evening, President Trump announced the selection of Kathy Kraninger as his choice to permanently head the Consumer Financial Protection Bureau. White House spokeswoman Lindsay Walters said on Saturday that Ms....

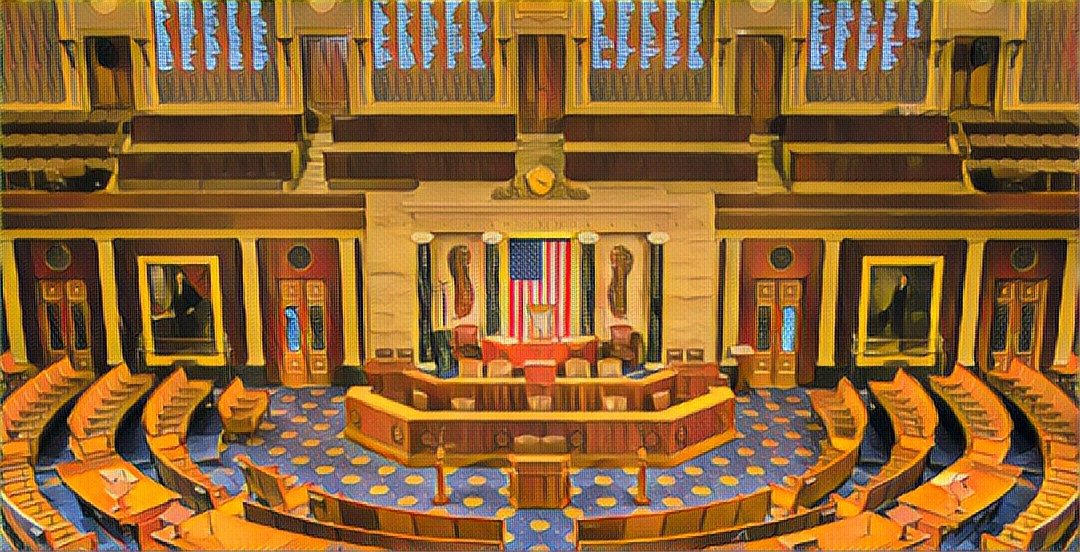

OCC Comptroller Otting Testifies before Congress

← Previous Article Next Article → This week, Joseph Otting, head of the Office of the Comptroller of the Currency (OCC) headed to Capitol Hill for a dual round of hearings before the House Committee on Financial Services on Wednesday and the Senate Banking...

SCOTUS Offers a Victory on Tribal Treaty Rights

← Previous Article Next Article → On Monday, the Supreme Court of the United States handed down its decision in Washington v. U.S., a case that had been watched closely by Indian country because of its potential impact on Native American treaty rights. “This...

CFSA Exec “Skeptical” About Banks Entering Short-Term, Small-Dollar Lending Industry

← Previous Article Next Article → Last month, both the Office of the Comptroller of the Currency (OCC) and the National Credit Union Administration (NCUA) issued proposals to allow banks and credit unions to offer short-term, small-dollar lending products....

House Financial Services Looks at CFPB Changes

← Previous Article Next Article → In a hearing last week convened by the House Financial Services’ Financial Institutions and Consumer Credit Subcommittee, members of Congress on the panel considered four statutory changes to the structure of the Consumer...

Senate Committee Advances Nomination of Tara Sweeney to be Assistant Secretary for Indian Affairs

← Previous Article Next Article → Nearly a month after the Senate Committee on Indian Affairs held confirmation hearings for Tara Sweeney, President Trump’s nominee to lead the Bureau of Indian Affairs, the Committee has advanced her nomination, clearing it...