Closed-End Loan Delinquencies Fall in the Fourth Quarter of 2018

← Previous Article Next Article → The American Bankers Association (ABA) released new data yesterday covering loan delinquencies. Most closed-end loans saw a fall in delinquencies in the fourth quarter of 2018 while most open-ended loans saw a small...

New Report: Native Credit Unions Provide Needed Services for Tribal Communities

← Previous Article Next Article → Native credit unions, especially those that are certified as community development financial institutions (CDFIs), “offer the broadest array of products and services focused on the individual needs of low-income and...

Banking Deserts: Fact or Fiction?

← Previous Article Next Article → Banking deserts may not be as big of a problem as typically reported, according to a new study by the Bank Policy Institute (BPI). “Our results indicate that almost every statement made thus far about banking deserts and on...

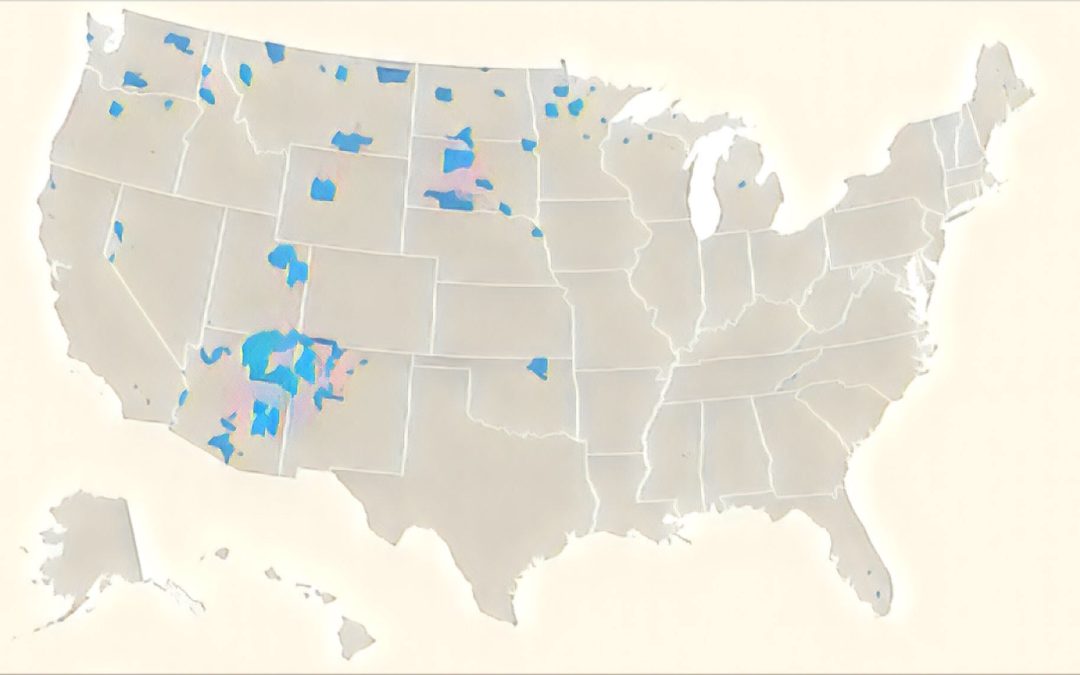

Opportunity Zones in Indian Country

← Previous Article Next Article → The Tax Cuts and Jobs Act of 2017 introduced a new term to the tax code called Opportunity Zones. These are defined as an “economically-distressed community where new investments, under certain conditions, may be eligible...