Improving Access to Credit by Revamping FICO Scores

After years in development, the Fair Isaac Corporation (FICO) has unveiled its new credit scoring system called UltraFICO. The new system provides consumers the opportunity to modify their credit score by allowing lenders to use data from the borrowers’ banking statements.

According to reports, if a lender rejects a prospective borrower for a loan, the borrower could request the lender to recalculate their score using UltraFICO. This would entail the borrower authorizing the lender to utilize banking statements, which could include “the length of time accounts have been open, frequency of activity, and evidence of saving.”

This new borrower data will be aggregated by Finicity – a consumer reporting agency – while Experian plc – a credit bureau – fills out the new score with its consumer credit information. A pilot program of the new system is expected to debut in early 2019 with full implementation by mid-2019.

On their website, FICO argues that UltraFICO will improve credit visibility by providing lenders’ a better scorecard for those who are currently underbanked.

“With the UltraFICO Score, consumers are empowered to contribute their checking, savings or money market account data to be leveraged by the score, providing an unprecedented and broader view for lenders to assess credit worthiness,” says FICO’s website. “Seven out of 10 consumers who exhibit responsible financial behavior in their checking and savings accounts could improve their score with the UltraFICO Score.”

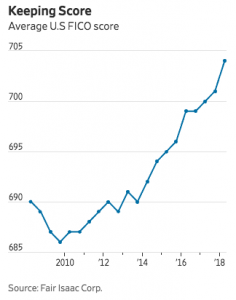

Already, FICO scores are near historic highs. Nearly 60 percent of Americans who have FICO credit scores have a score of 700 or higher, and the average FICO score is 704. (see graph below).

The record high is partly because Experian, Equifax, and TransUnion – the three major credit bureaus – announced in April that they would exclude tax liens from credit reports, which led to a general boost to average credit scores. Also, consumer delinquency has decreased dramatically over the past decade, and is currently at 23.0 percent, down from 25.8 percent just last year.