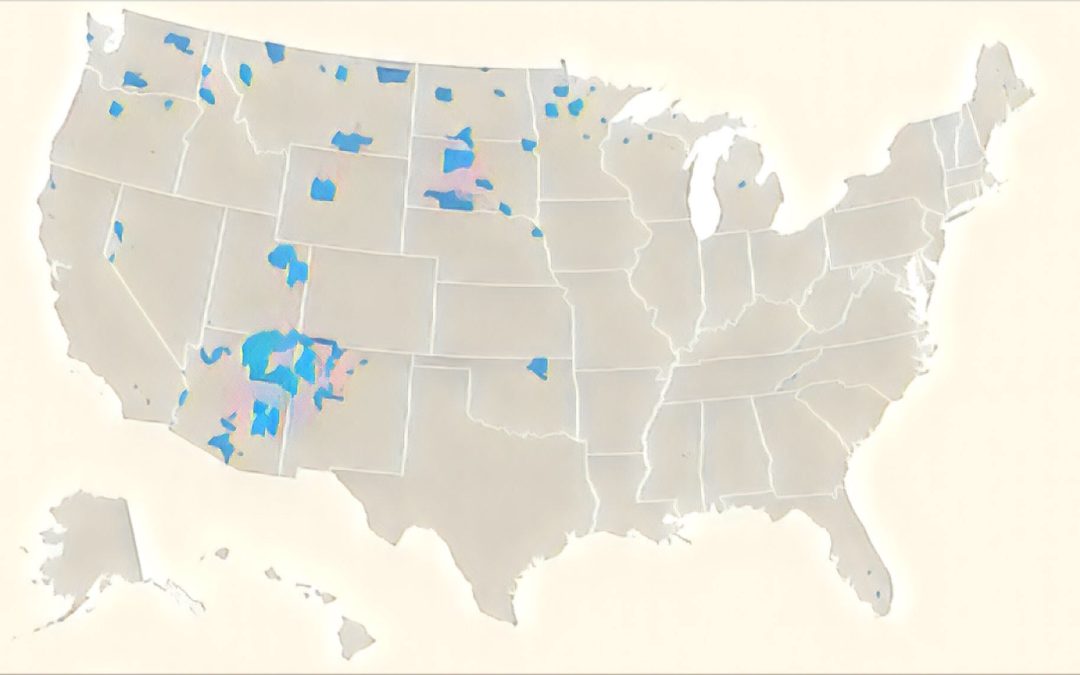

Opportunity Zones in Indian Country

← Previous Article Next Article → The Tax Cuts and Jobs Act of 2017 introduced a new term to the tax code called Opportunity Zones. These are defined as an “economically-distressed community where new investments, under certain conditions, may be eligible...

Fintech Outpaces Banks and Credit Unions in Personal Loans

← Previous Article Next Article → According to a recent report by TransUnion, personal loan balances reached a record $138 billion in 2018. The growth in personal loans was led by fintech firms, which made more personal loans than banks, credit unions, and...

Midland Funding Case Reaches a Settlement

← Previous Article Next Article → In 2015, the Second Circuit Court of Appeals issued a ruling in Madden v. Midland Funding that seemed to overturn the “valid-when-made” doctrine, sending shock waves through the financial services sector. Denied a hearing by...

Kraninger Files First Lawsuit as Head of the CFPB

← Previous Article Next Article → The Consumer Financial Protection Bureau (CFPB), has filed a lawsuit seeking to enforce a Civil Investigative Demand (CID) against the Law Offices of Crystal Moroney, (LOCM) a debt collection law firm. It is the first CFPB...

Is there Bipartisan Consensus on Reforming the Credit Reporting System?

← Previous Article Next Article → At a House Financial Services Committee hearing on Tuesday, February 26, Congresswoman Maxine Waters (D-CA-43), chairwoman of the Committee, openly questioned whether the credit reporting sector “is so beyond repair that we...

Government Report: Recommendations for OCC to Reduce Regulatory Capture

← Previous Article Next Article → There are nine ways that the Office of the Comptroller of the Currency (OCC) can reduce the risk of regulatory capture, according to the Government Accountability Office (GAO). The OCC, led by the Comptroller of the Currency...

Congresswoman Waters Pens Letter to CFPB Employees

← Previous Article Next Article → Congresswoman Maxine Waters (D-CA-43), chair of the House Financial Services Committee, recently penned an open letter to the staff of the Consumer Financial Protection Bureau (CFPB), urging them to publicly report any...

Bank Profits Shattered Records in 2018

← Previous Article Next Article → Banks made more profits in 2018 than ever before in recorded history. According to recently released data from the Federal Deposit Insurance Corporation (FDIC), banks made more than $236.7 billion in 2018, which is 44.1...