CFPB Announces New Rulemaking on Debt Collection Practices

← Previous Article Next Article → The Consumer Financial Protection Bureau (CFPB) released its annual report on the Fair Debt Collection Practices Act (FDCPA) earlier this week. In the report, the CFPB announced that it would issue a Notice of Proposed...

Kraninger Empowers CFPB Advisory Boards

← Previous Article Next Article → Last Thursday, the Consumer Financial Protection Bureau (CFPB) announced that it would be making several changes to the CFPB Advisory Committees, providing the committee members longer terms and increasing the frequency of...

The Administration and Congress Mull Changes to the Equal Credit Opportunity Act

← Previous Article Next Article → Earlier today, the Consumer Financial Protection Bureau (CFPB) issued a request for comments on the Equal Credit Opportunity Act (ECOA), a federal law that makes it illegal for any creditor to discriminate against any...

The CFPB Defends its Constitutionality in Second Circuit

← Previous Article Next Article → In an appeal filed last Friday, the Consumer Financial Protection Bureau (CFPB) argued that its organizational structure, including its “for-cause removal” provision, was constitutional because it met U.S. Supreme Court...

The Indian Loan Guarantee Program: Facilitating Economic Opportunities in Indian Country

← Previous Article Next Article → On February 15, Congress provided $10.8 million to the Indian Loan Guarantee Program for the 2019 fiscal year, an increase of 16 percent from the year before. This important program provides financial institutions a great...

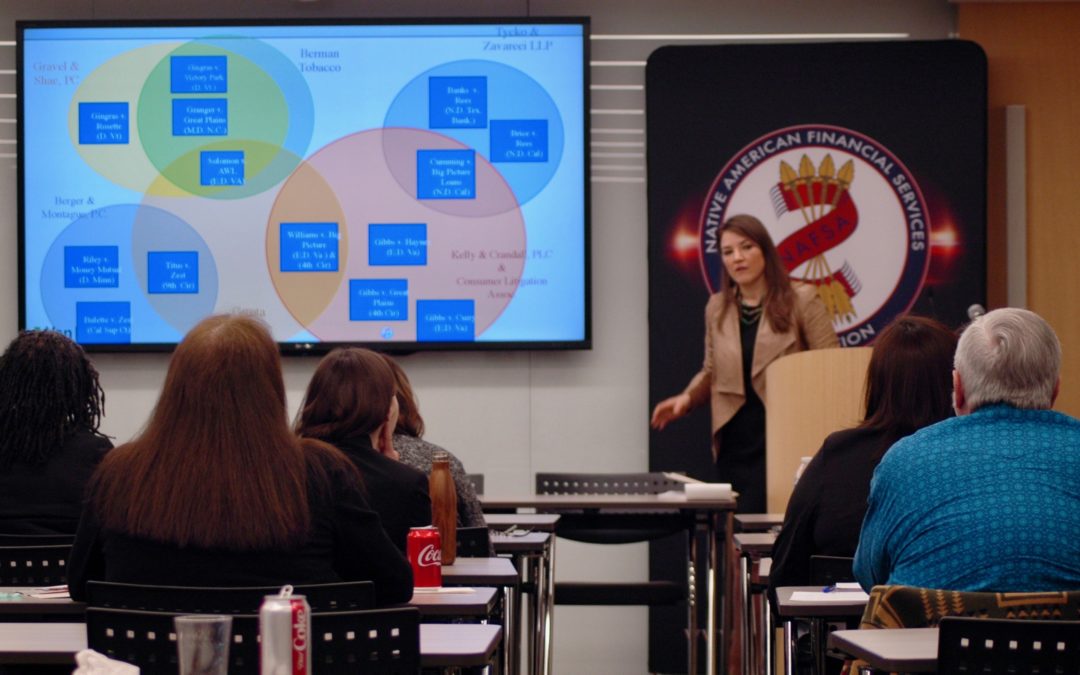

NAFSA Hosts Second Annual Tribal Lending Regulatory Workshop

← Previous Article Next Article → Yesterday, the Native American Financial Services Association (NAFSA) hosted its Second Annual Tribal Lending Regulatory Workshop. Tribal lending regulators, compliance officers, attorneys, and tribal officials gathered at...

President’s Budget Proposes Changes to CFPB Funding Structure

← Previous Article Next Article → Last Monday, President Trump sent Congress a record $4.8 trillion budget proposal for the 2020 fiscal year. The budget also includes a proposal that would subject the Consumer Financial Protection Bureau (CFPB) to...

CFPB Director Kraninger Faces the Senate Banking Committee

← Previous Article Next Article → Following a contentious hearing with the House Financial Services Committee last week, Consumer Financial Protection Bureau (CFPB) Director Kathy Kraninger testified before the Senate Banking Committee this morning in a...