Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

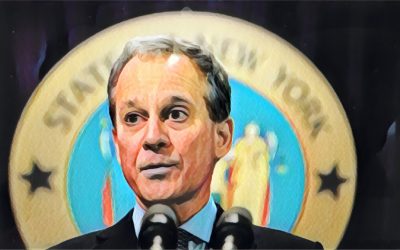

Blue State AGs Vow to Up Enforcement As CFPB Leadership Fight Distracts Agency

While Consumer Financial Protection Bureau (CFPB) Deputy Director Leandra English and interim Director Mick Mulvaney argue in federal court over who gets to lead the agency until a permanent replacement for Richard Cordray can be confirmed by the Senate,...

GAO Study Explores Minorities in Financial Services Industry

A recent survey of government employment data by the Government Accountability Office (GAO), an independent, non-partisan agency that serves as a “Congressional watchdog,” explores the presence of minorities in management positions at financial services...

FSOC Warns of Cybersecurity Threats, Pushes Deregulation in Annual Report

The Financial Stability Oversight Council (FSOC) issued its annual report on the activities of the group and significant market developments and threats for 2017 shortly before Washington closed down for the holiday season. FSOC was created to “identify...