Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

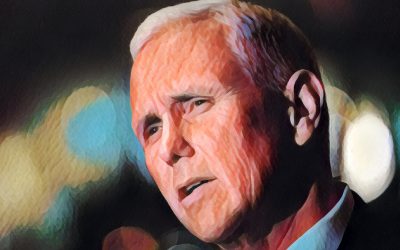

Pence Breaks Tie, Senate Votes to Repeal Arbitration Rule

Barely one day after the U.S. Department of the Treasury issued a report on the likely monetary and compliance impacts of the new regulation, a split 50-50 Senate led Vice President Pence to cast the deciding vote in favor of repealing the Consumer Financial...

Treasury Report Slams Potential Impact of CFPB Arbitration Rule

Only a few weeks after Acting Comptroller of the Currency Keith Noreika expressed concern over the added costs associated with the recently issued arbitration rule, the U.S. Department of the Treasury released a report on Monday detailing the likely monetary and...

As Online Financial Services Shift, Mainstream Institutions Join the Fray

The Consumer Financial Protection Bureau (CFPB) issued its long-anticipated small dollar rule earlier this month, a regulation that could eliminate 80% of the payday loan business. For the estimated 12 million people that regularly rely upon payday products, other...