Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

OCC Expands Discussion On FinTech Charters to Cryptocurrencies

In recent months, Acting Comptroller of the Currency Keith Noreika has traveled the country discussing the prospects of special purpose bank charters for financial technology (FinTech) institutions. Noreika is standing in as head of the Office of the Comptroller of...

Natural Disaster Recovery Sparks Jump in Consumer Spending

In the wake of major hurricanes in Texas, Florida, and Puerto Rico, Secretary of Commerce Wilbur Ross announced a 3% increase in Gross Domestic Product (GDP) for the 3rd quarter of 2017. In particular, consumer spending jumped one percent in September alone, one of...

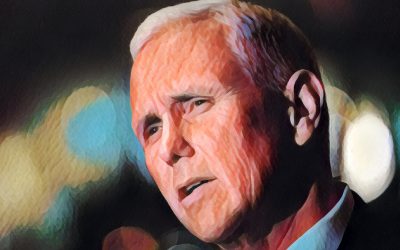

Pence Breaks Tie, Senate Votes to Repeal Arbitration Rule

Barely one day after the U.S. Department of the Treasury issued a report on the likely monetary and compliance impacts of the new regulation, a split 50-50 Senate led Vice President Pence to cast the deciding vote in favor of repealing the Consumer Financial...