Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

OCC FinTech Charters Still Not Ready for Deployment

Speaking to a conference this week in New York, Acting Comptroller of the Currency Keith Noreika reiterated that his agency’s proposal to issue special purpose bank charters to fintech companies is still in an “exploratory phase.” His comments come at a time when...

House-Passed Appropriations Bill Includes Significant Dodd-Frank Reforms

The House passed a series of appropriation bills along party lines late Thursday deviating somewhat from President Trump’s original budget proposal, but also comprising some major changes over the last fiscal year. The financial services bill incorporated many of the...

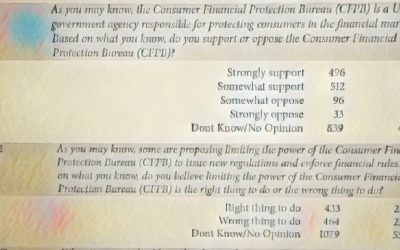

New Poll Shows Voters Split on Limiting CFPB Power

A new survey by Morning Consult and Politico found that Americans are split on limiting the power of the Consumer Financial Protection Bureau (CFPB). 22% of respondents felt limiting the CFPB was the right thing to do, while 23% believed restricting the federal...