Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

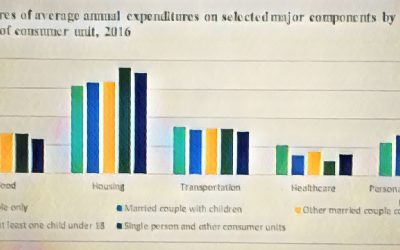

BLS Releases Report On Consumer Spending

The Bureau of Labor Statistics reported late last week that consumer spending was up 2.4% in 2016 to $57,311, but fell short of the 4.6% increase in 2015. Expenditures rose sharply for rental housing last year, as rental spending once again outpaced mortgage expenses....

Scott Tucker Nears Trial for Payday Loan Rent-a-Tribe Scheme

A New York federal district court is preparing to hear the trial of payday-lender-turned-race-car-driver Scott Tucker beginning September 11th. Last year, federal district attorneys brought a $2 billion action against Tucker and his business associate, Timothy Muir,...

FinTech Poised to Capture Burgeoning Millennial Small Businesses

While the biggest banks continue to ignore credit demands from small businesses, FinTech companies are finding ways to help the nearly 28 million small businesses in America. Public-private partnerships are moving payment processing to the next level, and FinTech...