Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

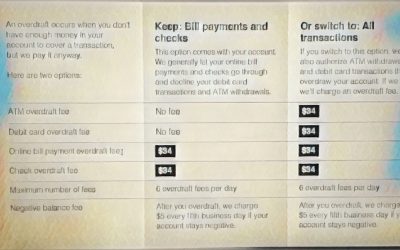

CFPB Considers New Disclosures for Overdraft Coverage

On the back of reports that Americans spent $15 billion last year in bank overdraft fees, the Consumer Financial Protection Bureau (CFPB) is mulling new standard disclosure forms for banks that allow customers to opt-in to overdraft protection. In addressing the new...

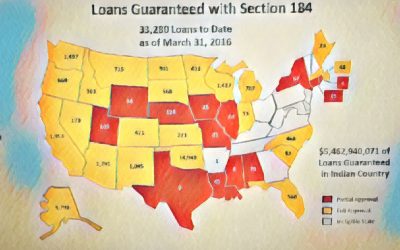

How TLEs Are Helping Shrink Housing Inequality in Tribal Communities

In the wake of the mortgage crisis of 2008, a bipartisan Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) to stabilize financial markets and shield consumers from predatory financial products and services. Following the...

Proposed Budget Resolution Includes Changes to Dodd-Frank

The newly proposed federal budget bill for fiscal year (FY) 2018 (House Concurrent Resolution 71) contains a number of provisions that could reshape key sections of the Dodd-Frank Act. The proposed budget is part of a larger 10 year plan to balance the federal budget...