Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

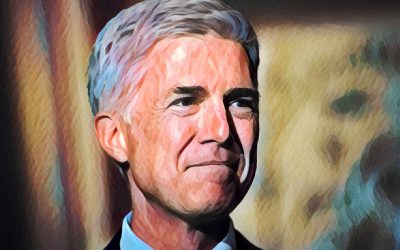

Gorsuch Tackles Debt Collection in First Opinion for Supreme Court

Newly appointed Justice Neil Gorsuch issued his first opinion on June 12th for a unanimous court in a case concerning who qualifies as a debt collector under the Fair Debt Collection Practices Act (FDCPA). In Henson v. Santander Consumer USA Inc., Santander...

Hiding in Plain Sight: the Issue of Credit Invisibility in America

The Consumer Financial Protection Bureau recently released a follow up to its 2015 study on credit invisibility in the United States. A person is “credit invisible” when they lack the data needed to calculate a credit score (invisible) or their credit data is so old...

House Mulls Contempt Charges for CFPB Director

On the heels of passing a bill that would severely curtail the authority of the Consumer Financial Protection Bureau (CFPB), House Financial Services Committee Chairman Representative Jeb Hensarling (R- TX) is considering holding CFPB Director Richard Cordray in...