Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

BuzzFeed: A Fight Between Native American Lenders And The Government Could Reach The Supreme Court

Consumer Financial Protection Bureau v. Great Plains Lending, LLC, et. al. is a very important court case for those operating in the tribal lending space, including NAFSA members. We took the time to explain some of the nuances about the case and the underlying issues...

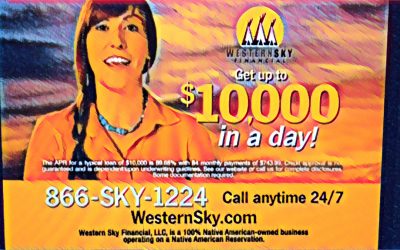

Western Sky and the Importance of Proper Legal Counsel in Online Lending

Last Tuesday, J. Paul Reddam, owner of the California-based lender, Cash Call, sued the law firm that previously helped him join forces with a private citizen living on tribal land to build his now-crumbling lending empire. Reddam alleges that attorneys at Katten...

Trump Nears 100 Days in Office, Signs Memos to Review Bank Oversight

The first one hundred days of a president’s term in office are typically a reflection point on the early efficacy of our nation’s top executive. One of President Trump’s chief concerns entering office in January was Wall Street regulation and the Dodd-Frank Act. He...