Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

FinTech Finds a Home in Britain (and Indian Country)

Deloitte, an international auditing, consulting and financial advisory firm, recently named London, England as a hub of the FinTech industry. Three of the top five hubs in the study, New York, Silicon Valley and Chicago, operate in the United States. The goal of the...

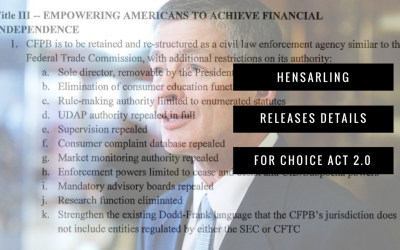

Hensarling Releases Details for CHOICE Act 2.0

Following up on a memo distributed in February, Rep. Jeb Hensarling (R- TX), Chairman of the House Financial Services Committee, released more information on a proposed bill to renovate the Dodd-Frank Act, dubbed CHOICE Act 2.0. In particular, CHOICE Act 2.0 proposes...

Tools of the Trade: What NAFSA Does to Improve the Financial Literacy of Indian Country

Using data from its National Financial Capability Study, the FINRA Foundation recently teamed up with the First Nations Development Institute to issue a report on the financial capabilities of Native Americans entitled “Race and Financial Capability in America:...