Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

OCC Adds Marketplace Lenders to 3rd Party Risk Management Rule

Late last month the U.S. Department of the Treasury’s Office of the Comptroller of the Currency (OCC) issued a bulletin updating risk management procedures for financial institutions working with 3rd parties by adding marketplace lenders. “Marketplace lender” is...

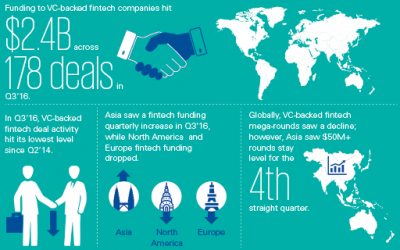

FinTech Investment by Venture Capital Down in Q3 2016, But Trending Up

*Source: The Pulse of Fintech, Q3 2016, Global Analysis of Fintech Venture Funding, KPMG International and CB Insights (data provided by CB Insights) November 16th, 2016. A recent quarterly report by international auditing firm KPMG signals a positive trend in venture...

CFPB: Potential Rule Allows Alternative Data Sources to Score Credit

The CFPB is currently requesting feedback on the potential and risks of using alternative data sources to determine credit scores for financial products. Alternative data sources include rent payments, utility and cell phone bills and other non-traditional credit...