The Latest Financial News

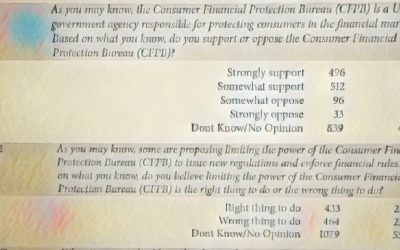

New Poll Shows Voters Split on Limiting CFPB Power

A new survey by Morning Consult and Politico found that Americans are split on limiting the power of the Consumer Financial Protection Bureau (CFPB). 22% of respondents felt limiting the CFPB was the right thing to do, while 23% believed restricting the federal...

Census Bureau Says Average Income Up, Poverty Levels Down

The U.S. Census Bureau recently released data related to income, poverty, and health insurance coverage in the United States. The Bureau found that median household incomes are up 3.2% since 2015 to $59,039 and poverty had fallen to a rate of 12.7%. Further, health...

Judge Orders Transfer of Upper Lake TLE Case to Kansas

A federal district judge in Illinois granted a motion to transfer venue to Kansas on September 8th in a case pitting the Consumer Financial Protection Bureau (CFPB) against four tribal lending entities (TLEs) owned and operated by the Habematolel Pomo of Upper Lake....

Why NAFSA?

There are more than 570 federally-recognized tribes in the United States, many of whom are spread across in diverse areas. This has left a need for other tribal economic development opportunities to create sustainability and jobs on Native American reservations.

Tribal Financial Services:

![]() Create jobs & economic development on tribal lands

Create jobs & economic development on tribal lands

![]() Increase the financial independence of tribes

Increase the financial independence of tribes

![]() Deploy sovereignty & bolster tribal self-determination

Deploy sovereignty & bolster tribal self-determination

The Impact of Tribal Financial Services

Coming from a history of staggering unemployment rates, limited opportunities, and lack of access to fundamental resources, Native American tribes began online lending businesses to create real change for the future. Internet commerce has been a vehicle for supporting economic growth, tribal services, and tribal development. These are their stories.

Our Mission

To advocate for tribal sovereignty, promote responsible financial services, and provide better economic opportunity in Indian Country for the benefit of tribal communities.