The Latest Financial News

DOJ Joins Another Suit to Challenge Constitutionality of CFPB

Mortgage servicer Ocwen Financial will have support in its bid to have the structure of the Consumer Financial Protection Bureau (CFPB) declared unconstitutional after a Florida judge recently ruled that the U.S. Attorney General’s office could provide its views on...

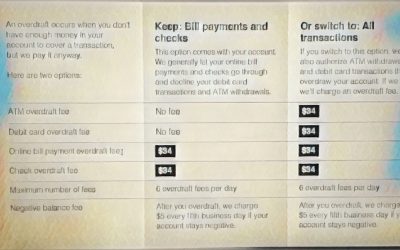

CFPB Considers New Disclosures for Overdraft Coverage

On the back of reports that Americans spent $15 billion last year in bank overdraft fees, the Consumer Financial Protection Bureau (CFPB) is mulling new standard disclosure forms for banks that allow customers to opt-in to overdraft protection. In addressing the new...

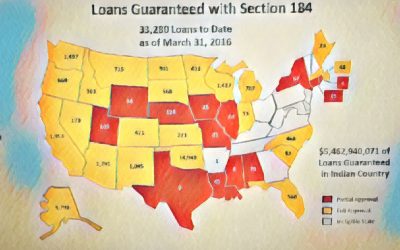

How TLEs Are Helping Shrink Housing Inequality in Tribal Communities

In the wake of the mortgage crisis of 2008, a bipartisan Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) to stabilize financial markets and shield consumers from predatory financial products and services. Following the...

Why NAFSA?

There are more than 570 federally-recognized tribes in the United States, many of whom are spread across in diverse areas. This has left a need for other tribal economic development opportunities to create sustainability and jobs on Native American reservations.

Tribal Financial Services:

![]() Create jobs & economic development on tribal lands

Create jobs & economic development on tribal lands

![]() Increase the financial independence of tribes

Increase the financial independence of tribes

![]() Deploy sovereignty & bolster tribal self-determination

Deploy sovereignty & bolster tribal self-determination

The Impact of Tribal Financial Services

Coming from a history of staggering unemployment rates, limited opportunities, and lack of access to fundamental resources, Native American tribes began online lending businesses to create real change for the future. Internet commerce has been a vehicle for supporting economic growth, tribal services, and tribal development. These are their stories.

Our Mission

To advocate for tribal sovereignty, promote responsible financial services, and provide better economic opportunity in Indian Country for the benefit of tribal communities.