The Latest Financial News

Bashing Payday Lenders

A recent Wall Street Journal article discusses how Congress’s rush to punish banks and other financial institutions may actually be hurting those same low-income earners again by limiting payday lending. Payday lend shops lend between $100 and $500 for short periods...

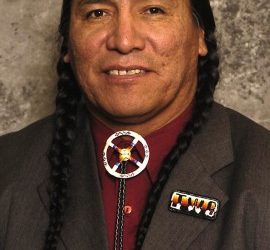

Montana Senator Sheds Light on Chippewa Cree’s Plain Green Loans

Because of growing restrictions on payday loans, banks and payday lenders are teaming up with American Indian businesses. Indian country offers a loophole, sovereign immunity, that shields companies from the U.S. government’s mandated interest rate caps and other...

Majority Believes U.S. Government has too many Regulations

70% of Americans Support Tribal Lending Rights; Overwhelming Majority Says Government Should Honor Native American Treaties UTICA, NY – Only 13 percent of those surveyed think Americans need more government regulations, according to a recent IBOPE Zogby International...

Why NAFSA?

There are more than 570 federally-recognized tribes in the United States, many of whom are spread across in diverse areas. This has left a need for other tribal economic development opportunities to create sustainability and jobs on Native American reservations.

Tribal Financial Services:

![]() Create jobs & economic development on tribal lands

Create jobs & economic development on tribal lands

![]() Increase the financial independence of tribes

Increase the financial independence of tribes

![]() Deploy sovereignty & bolster tribal self-determination

Deploy sovereignty & bolster tribal self-determination

The Impact of Tribal Financial Services

Coming from a history of staggering unemployment rates, limited opportunities, and lack of access to fundamental resources, Native American tribes began online lending businesses to create real change for the future. Internet commerce has been a vehicle for supporting economic growth, tribal services, and tribal development. These are their stories.

Our Mission

To advocate for tribal sovereignty, promote responsible financial services, and provide better economic opportunity in Indian Country for the benefit of tribal communities.