Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

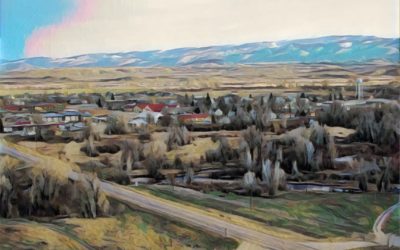

Banking Deserts: Fact or Fiction?

Banking deserts may not be as big of a problem as typically reported, according to a new study by the Bank Policy Institute (BPI). “Our results indicate that almost every statement made thus far about banking deserts and on the inclusiveness of the U.S. banking system...

The Importance of Saving for the Future

April is Financial Literacy Month, a great time to hone your financial wellness and an opportunity to reassess your savings goals. A lack of sufficient savings is a problem for many people in the United States. According to a Federal Reserve report, “Four in 10...

The Use of Subcontractors by Tribal Businesses

The use of third-party contractors or subcontractors is a common and growing business practice in America. It is utilized by both small businesses and large multinational corporations for a variety of reasons, including obtaining economies of scale or increasing...