Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

Senate Democrats Attempt to Federally Enforce State Usury Laws

Senator Jeff Merkley (D-OR) and Congresswoman Suzanne Bonamici (D-OR) recently introduced the Stopping Abuse and Fraud in Electronic (SAFE) Lending Act, a bill that would require small-dollar lenders to register with the Consumer Financial Protection Bureau (CFPB) and...

House Financial Services Committee Hearing Highlights the Continued Partisan Divide Over the CFPB

Consumer Financial Protection Bureau (CFPB) Director Kathy Kraninger made her first appearance before the House Financial Services Committee on Thursday, March 7 at a hearing entitled, “Putting Consumers First? A Semi-Annual Review of the Consumer Financial Protection...

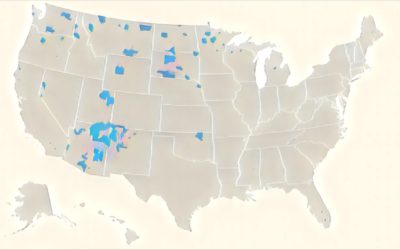

Opportunity Zones in Indian Country

The Tax Cuts and Jobs Act of 2017 introduced a new term to the tax code called Opportunity Zones. These are defined as an “economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment.” Currently,...