Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

Fed Shows Worth as Trump Considers Next Chair

The Federal Reserve acts as the central bank for the United States, setting American monetary policy, promoting financial stable markets, supervising financial institutions, maintaining the safety and efficiency of American payment systems, and pursuing community...

Member Alert: CFPB bans consideration of tribal status/sovereignty in Zero Parallel consent order

A similar version of this post was sent to NAFSA members on September 14th. Last week, the Consumer Financial Protection Bureau (CFPB) entered into a consent order with lead generator Zero Parallel, which includes a provision specifically banning the consideration of...

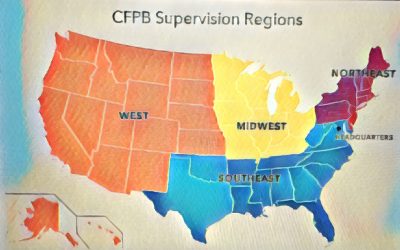

CFPB Issues Supervisory Highlights for Summer 2017

The Consumer Financial Protection Bureau (CFPB) recently published a report on its supervisory activity for the period from January 2017 to June 2017. The purpose of CFPB supervision is to determine if an institution is complying with federal laws and impose...