Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

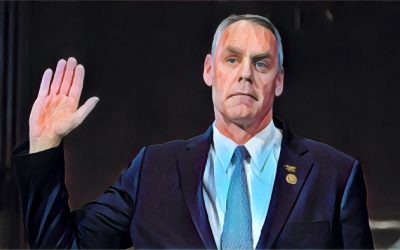

Ryan Zinke Confirmed as Secretary of the Interior

Earlier this morning the U.S. Senate confirmed Rep. Ryan Zinke (R- MT) as the 52nd U.S. Secretary of the Interior. Secretary Zinke will oversee a diverse collection of federal agencies including the National Park Service, Minerals Management Service, Bureau of...

NAFSA advocates for Tribal Financial Services on Capitol Hill

Gary Davis meets with Senator Steve Daines (R-MT) on February 28, 2017. Executive Director Gary Davis meets with Congressional members to build awareness and present the facts on Tribal Financial Services This week, Native American Financial Services Association’s...

NAFSA is the Presenting Sponsor at NCAIED’s 2017 National Reservation Economic Summit (RES)

The Native American Financial Services Association is proud to announce that it will be the presenting sponsor for the NCAIED’s National Reservation Economic Summit, commonly known as “National RES.” National RES is the longest running and most well attended Indian...