Fintech Lenders Utilize Alternative Data to Visualize “Credit Invisibles”

A new report by the Aite Group, prepared for and published by Experian, highlights the various ways that fintech lenders utilize alternative data to serve borrowers who may be rejected by traditional financial institutions like banks and credit unions.

Today, more than 45 million American adults, about 20 percent of the U.S. adult population, lack a credit score. This includes people who are credit invisible (those who completely lack a credit file). For others, their credit files may be too thin or outdated.

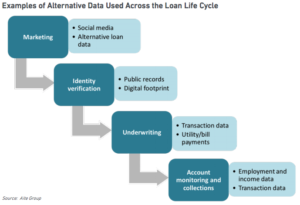

Without a credit file, lenders are not able to conduct an adequate cost-benefit analysis for borrowers, so may choose to forgo lending to this population segment altogether. Fintech lenders, however, have been using a variety of alternative data sources in order to serve the historically underserved. Those alternative data sources include the following:

Utility and Bill Payments – Credit files are partly developed from consumers’ payment history, yet credit files historically have not included consumers’ rent, utility, or bill payments. According to the report, “This data can also help a lender monitor for early signs of financial distress while a loan is being repaid.”

Loan Data from Specialty Bureaus – Traditional credit files do not typically include consumers’ payment history for alternative credit options like short-term installment loans or rent-to-own agreements. This can help lenders interested in extending credit to new customers who are likely to repay their loans but may have nonprime credit scores. In addition, online lenders have noted “that specialty bureau data can help them guard against the practice of ‘loan stacking,’ in which a borrower applies for multiple loans in rapid succession from different lenders.”

Bank Account Data – Fintech lenders are beginning to explore bank account and transaction data. For instance, Experian’s recent partnership with Finicity allows lenders to monitor a consumer’s bank account after receiving permission by the consumer. This data enables lenders “to more readily verify income and assets as well as perform cash flow analyses.”

Other Data – Fintech lenders utilize a variety of other data sources to help with lending decisions. A few fintech lenders, for example, include consumers’ educational data like the school attended and the degree earned as part of the underwriting process. In addition, fintech lenders may use aggregated reviews on social media platforms to determine small business potential.

Just a decade ago, most traditional lenders were not making lending decisions using data from social media, rental history, or bank accounts. As a result, millions of American adults lacked access to credit. Fortunately, fintech lenders and credit bureaus like Experian have pioneered new and innovative ways to gauge consumers’ credit score, which is a start to reducing credit invisibility in the United States.