The Latest Financial News

Biden Proposes Public Credit Reporting Agency in Policy Plan

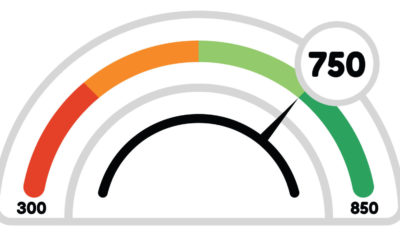

In a recent plan outlining the presumptive Democratic presidential nominee’s housing policies, Joe Biden has proposed creating a public credit reporting agency within the Consumer Financial Protection Bureau, which would compete with the three existing credit scoring...

CFPB Study Finds Credit Builder Loans Can Help Consumers Build Credit

The Consumer Financial Protection Bureau (CFPB) recently issued a report entitled “Targeting Credit Builder Loans: Insights from a Credit Builder Loan Evaluation,” which found that credit builder loans (CBLs) could help establish credit records and boost credit scores...

Dodd-Frank Act Turns Ten

Last week, on the 10th anniversary of the Dodd-Frank Act being signed into law, its major supporters praised its survival despite years of opposition. The legislation’s authors, former Senator Chris Dodd (D-Conn.) and former Representative Barney Frank (D-Mass.),...

Why NAFSA?

There are more than 570 federally-recognized tribes in the United States, many of whom are spread across in diverse areas. This has left a need for other tribal economic development opportunities to create sustainability and jobs on Native American reservations.

Tribal Financial Services:

![]() Create jobs & economic development on tribal lands

Create jobs & economic development on tribal lands

![]() Increase the financial independence of tribes

Increase the financial independence of tribes

![]() Deploy sovereignty & bolster tribal self-determination

Deploy sovereignty & bolster tribal self-determination

The Impact of Tribal Financial Services

Coming from a history of staggering unemployment rates, limited opportunities, and lack of access to fundamental resources, Native American tribes began online lending businesses to create real change for the future. Internet commerce has been a vehicle for supporting economic growth, tribal services, and tribal development. These are their stories.

Our Mission

To advocate for tribal sovereignty, promote responsible financial services, and provide better economic opportunity in Indian Country for the benefit of tribal communities.