Our Resources

A Digital Financial Literacy Program

Too many consumers mismanage their budgets, make uninformed investment decisions, and fail to properly plan for the future. NAFSA is committed to empowering people with the skills they need to change this trend and thrive financially. NAFSA’s Financial Literacy Program offers an assortment of digital modules covering a wide variety of financial topics, including building emergency savings, mortgage education, and retirement planning.

Tribal Online Lending Best Practices

NAFSA has developed Best Practices for the exclusive use of all NAFSA Members as it relates to their Tribal Online Lending businesses. We believe these Best Practices will help ensure consumer protection, quality service, and positive customer and industry interactions during the life of the loans made by tribal lending entities who are NAFSA members. Our Best Practices apply to all stages of the loan, including marketing, origination, servicing, collecting, and ongoing data privacy.

The Latest Financial News

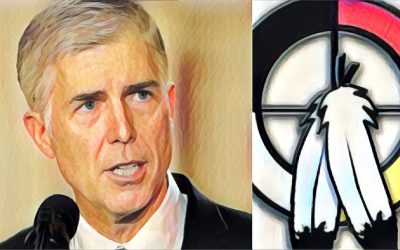

What the Nomination of Neil Gorsuch to the U.S. Supreme Court Might Mean for Indian Country

Yesterday, President Trump nominated Tenth Circuit judge Neil Gorsuch to fill the vacancy left at the U.S. Supreme Court by the death of Justice Antonin Scalia nearly one year ago. Gorsuch is a graduate of Harvard Law School and previously clerked for current Supreme...

Tribal Lending Enterprises – Helping the Millennial Generation Gain Access to Capital

Due to credit invisibility and Millennial credit rationed households, a significant portion of the American population is underserved by traditional bank services and products. To help fill this gap and ensure all Americans have access to capital, Tribal Lending...

CFPB v. Great Plains Lending, et al – Case Summary and Implications

LITIGATION ALERT: CFPB v. Great Plains Lending, et al - Case Summary & Implications On January 20, 2017, the United States Court of Appeals for the Ninth Circuit issued its opinion in Consumer Financial Protection Bureau v. Great Plains Lending, LLC, et. al.,...