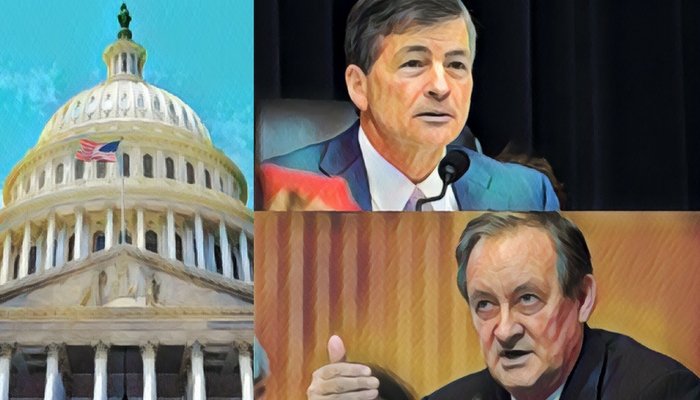

Senator Mike Crapo (R-ID) and Representative Jeb Hensarling (R-TX) couldn’t be more different in personality. Crapo is a soft-spoken, unassuming career politician from the mountain west. First elected in 1984, the Harvard law-educated Crapo has been an Idaho state senator, US representative and US senator, reelected in 2016 to his four term in the upper chamber.

Hensarling is the fire-brand son of Texas farmers was a career political aide before venturing into the business world. After a success run with several hedge funds, the Texas A&M-educated lawyer ran for open-seat in a newly created district. Incumbent Rep. Pete Sessions (R-TX) opted to run in a neighboring district over concerns that his old district had become too Democratic. Hensarling, a Republican, captured 58 percent of the vote.

Crapo has sought to forge bi-partisan compromises, while Hensarling appears content to push through policies on a party-line basis.

While their approaches to governing and paths may be different, what they have in common is the power to shape financial regulations over the next several years.

Crapo has taken over as chairman of the powerful Senate Banking Committee, the panel tasked with considering legislation over financial markets, housing and urban affairs. Hensarling remains atop the House Financial Services Committee, whose mandate is similar to that of the Banking Committee. However, for the first time in Hensarling’s tenure, he will have a Republican in the White House to enact legislation he can usher through the House and Senate.

Crapo has been relatively quiet about his legislative agenda for the new congress, while Hensarling has made it known that passage of the Financial CHOICE Act is his top priority. Among other things, the CHOICE Act would fundamentally alter the way the Consumer Financial Protection Agency is funded and operates. This would mean tribal online lenders could see regulatory relief if the legislation is enacted. The measure is expected to pass the House later this year.

Prospects for passage in the Senate are more doubtful, where nearly ever bill requires 60 votes for enrollment. However, given a recent DC District Court decision striking down the composition of the CFPB, there may be an appetite for bi-partisan action to reshape the agency.

Clearly, Crapo and Hensarling will play major roles in financial regulatory policy in the coming years and groups like NAFSA will be wise to engage with them and their staffs early in the legislative cycle.